Design industry “dividing into winners and losers,” says new financial report

Accountancy firm Moore Kingston Smith’s 2023 annual survey reveals a widening gulf between agencies achieving high margins, and those in “worst case” situations leading to redundancies.

Accountancy firm Moore Kingston Smith has just published its Annual Survey 2023, revealing a “mixed bag” of results for the design industry.

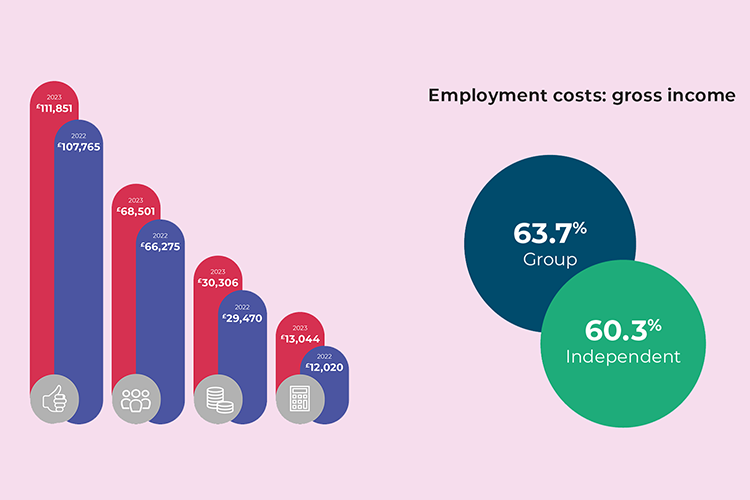

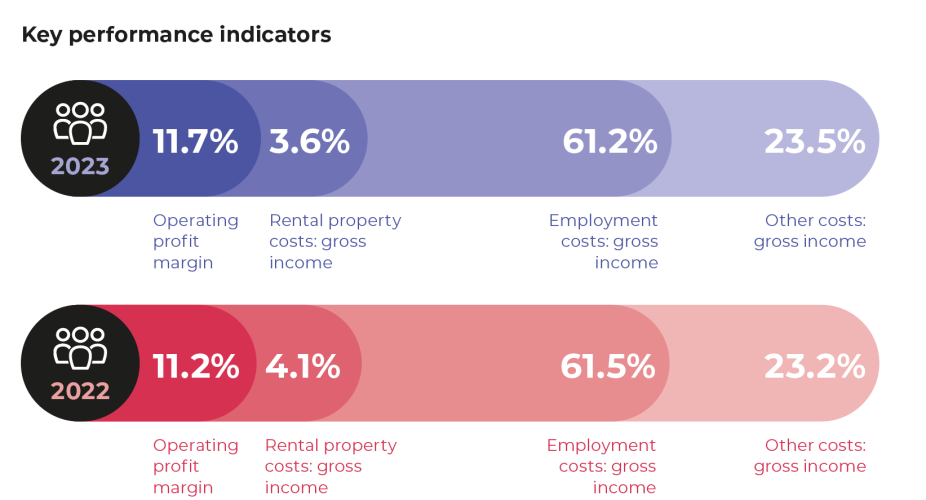

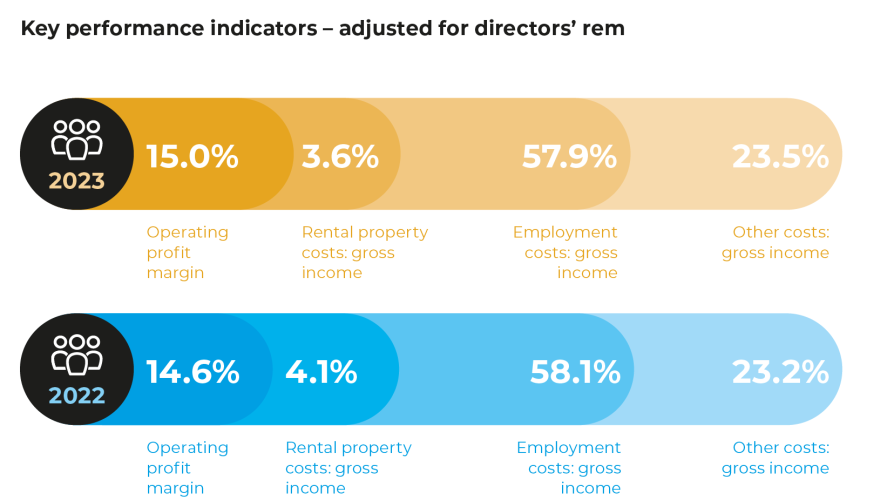

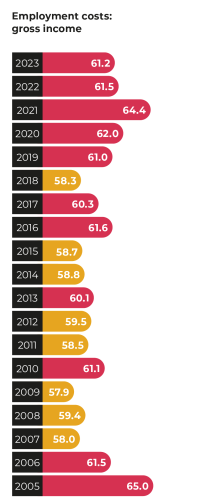

The survey analyses more than 250 companies, reviewing the performance of the top 30-50 companies across branding and design agencies, digital agencies, advertising agencies, independent and listed marketing services groups and more. The resulting report lays out financial performance statistics including profit ratios, productivity ratios and staff costs and numbers.

A “mixed bag” of results for design agencies

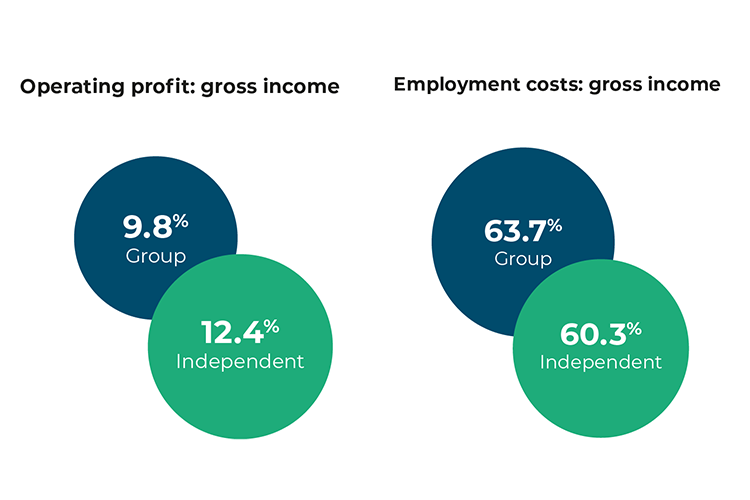

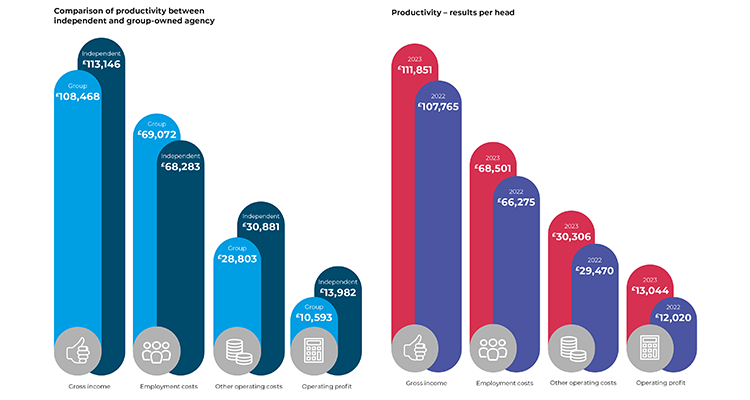

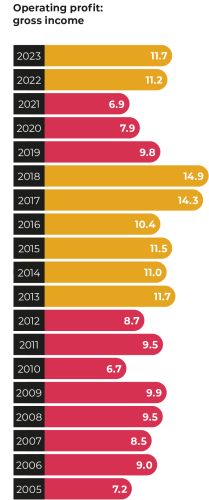

For the design agencies reviewed in the latest survey, 2022 was a “mixed bag” as gross income continued its “post-covid rebound with a second consecutive year of real growth and operating profit margin improvement,” the report states.

According to Moore Kingston Smith, this is “encouraging”, particularly given there was a real overall decrease in fee income not only in “the covid year”, 2020, but also in the two years prior to that.

“At face value 2022 was a positive year for agencies, reporting strong margins and revenue growth post-covid, before the full impacts of inflationary pressures kicked in,” says Moore Kingston Smith partner and head of media M&A Paul Winterflood. “The caveat being once revenue growth is adjusted for inflation, the design sector’s revenue increased in real terms by just 4.25%, indicating pressure on margins in 2023 and 2024 can be expected.”

Winterflood advises “notes of caution,” since while it was expected that 2022’s financials would show strong performance, “the ultimate test for agencies will be their 2023 performance.”

Winners and losers

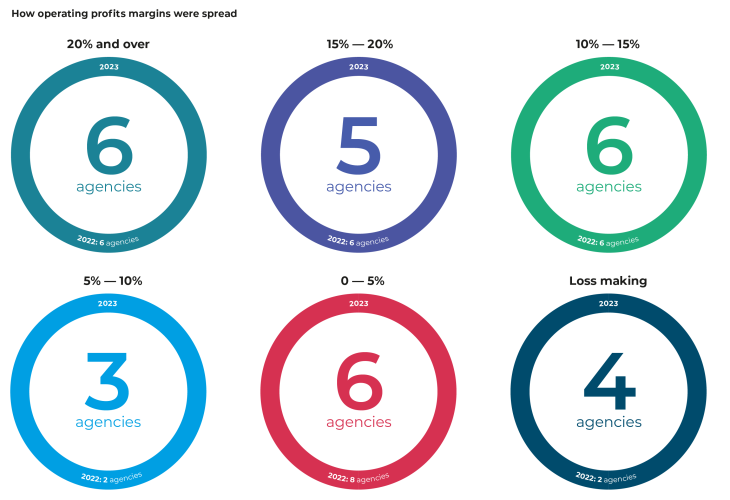

He adds that the latest numbers display “divergence in performance, with a clear split between winners – those generating high levels of revenue growth and strong margins, and losers – those suffering net falls in real revenue and delivering weak margins as a result,” adding that once the full impact of inflation comes into force, a margin reduction in 2023 is to be expected.

“We anticipate further divergence, with those agencies performing well continuing to achieve high margins, and those that aren’t, suffering real bottom line pressures making redundancies necessary in the worst cases,” says Winterflood. “We’re seeing the industry divide into winners and losers. The cost-of-living crisis, and future impact of AI will only increase this trend.”

While the report shows total fee income across design agencies grew by 13.3%, and many reported strong growth from new client wins, once inflation is stripped out this gives much lower real growth of around 4%. Only a third of the surveyed independent design agencies achieved real growth in revenues.

Advice for agencies

According to Winterflood, the 2023 survey findings mean that agency owners must keep in might that “a strong grasp on costs, a sought-after value proposition and strategic client relationships are the keys to success in a high inflationary environment.”

Meanwhile designers that want to achieve future financial success should note that “a razor-sharp focus on high quality, strategic work for clients is more crucial than ever”.

He adds, “Those [agencies] with a strong value proposition, often a consultative approach, and the ability to pass cost increases onto clients are set for success. Those that can’t, will unfortunately struggle.”

See below for more detailed figures from the 2023 Annual Survey:

-

Post a comment